League table reveals the most and least affordable places to buy a first home in Yorkshire - including Sheffield, Rotherham and Barnsley

and live on Freeview channel 276

Barnsley measured 3.7 on the first-time buyer house price to earnings ratio and the average first home costs £125,102.

Stacey Ferens, who heads the Simon Blyth estate agency office in Barnsley and who is Barnsley born and bred, says: “Our house prices are half that of some areas of Yorkshire and we have a thriving first-time buyer market, which has been very busy over the past year. Most of the buyers want three-bedroom semis with gardens and a garage rather than terraced houses as they are looking at staying long term in the properties.”

Advertisement

Hide AdAdvertisement

Hide AdThe majority of buyers are local and want to stay in the Barnsley area close to family and friends. “It’s a great place to live, people here are friendly, we have plenty of amenities and the transport links are very good,” says Stacey.

Hull is the second cheapest place for first-timers with a house price to earnings ratio of 3.8 and an average first-time buyer price of £115,581 and Doncaster is third with a ratio of 3.9 and an average price of £131,102.

Rural Ryedale, which includes the popular market towns of Malton and Pickering, along with many chocolate box villages, is the most expensive place for first-time buyers and measures 7 on the house price to earnings ratio, almost double that of Barnsley. The average first-time buyer home in this North Yorkshire hotspot costs £213,766.

York is a close second and is second priciest for those buying a first home with a ratio of 6.7 and an average first home price of £246,874. Richmondshire, which includes the popular towns of Richmond and Leyburn, along with a host of Yorkshire Dales villages and hamlets is the third least affordable place for first-timers to buy with a house price to earnings ratio of 6.5 and an average first home price of £208,135.

Advertisement

Hide AdAdvertisement

Hide AdCraven, which includes the market town of Skipton and parts of the Yorkshire Dales, has sprung a surprise by recording an improvement in affordability over the last five years.

It had an earnings to house price ratio of 6.5 and is now 5.5, which will baffle many who have seen the area boom, particularly since the pandemic when there has been flight from cities and large towns to rural areas.

The full list of Yorkshire local authority areas from most affordable to most expensive is as follows, the first figure is the house price to earnings ratio and the second is the average first time buyer house price:

Barnsley 3.7, £125,102;

Hull 3.8, £115,581;

Calderdale 4.2, £142,436;

Bradford 4.2, £138,658;

Kirklees 4.4, £146,588;

Rotherham 4.4, £141,231;

East Riding 4.6, £166,147;

Wakefield 4.6, £152,779;

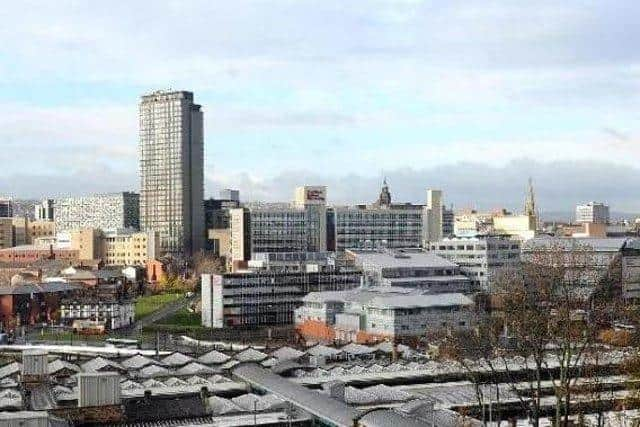

Sheffield 4.7, £164,157;

Selby 4.7, £188,304;

Scarborough 5.1, £161,511;

Leeds 5.1, £182,593;

Craven 5.5, £207,208;

Harrogate 6.2, £245,393;

Hambleton 6.5, £211,965;

Richmondshire 6.7, £208,135;

York 6.7, £246, 874;

Ryedale 7, £213,766